- Your cart is empty

- Continue Shopping

Product Description

Easily Plan Your Loan Repayments with our Personal Loan Calculator

Easily Plan Your Loan Repayments

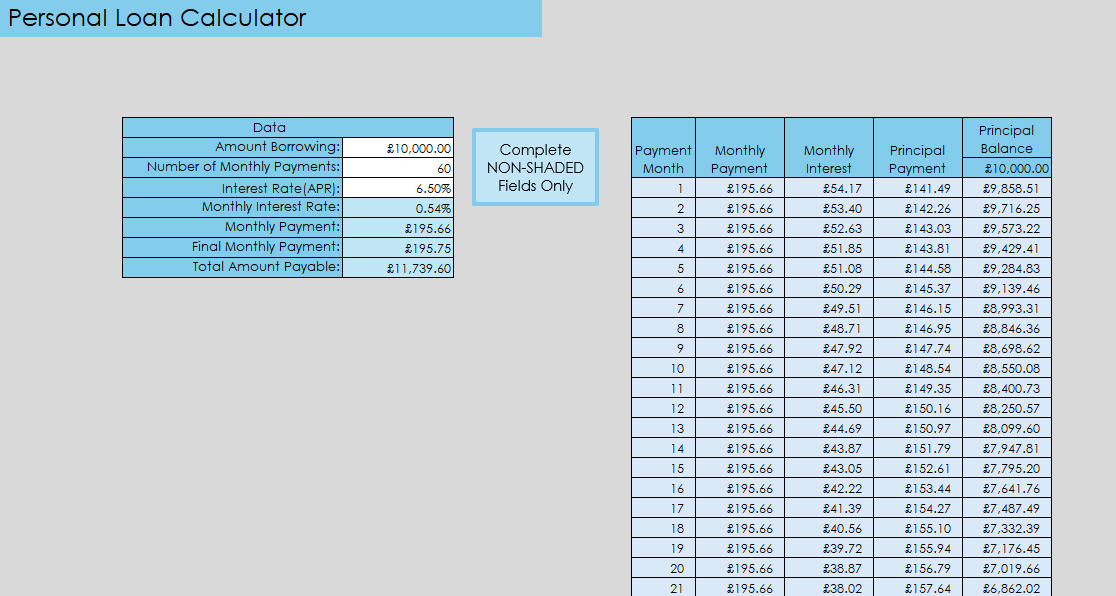

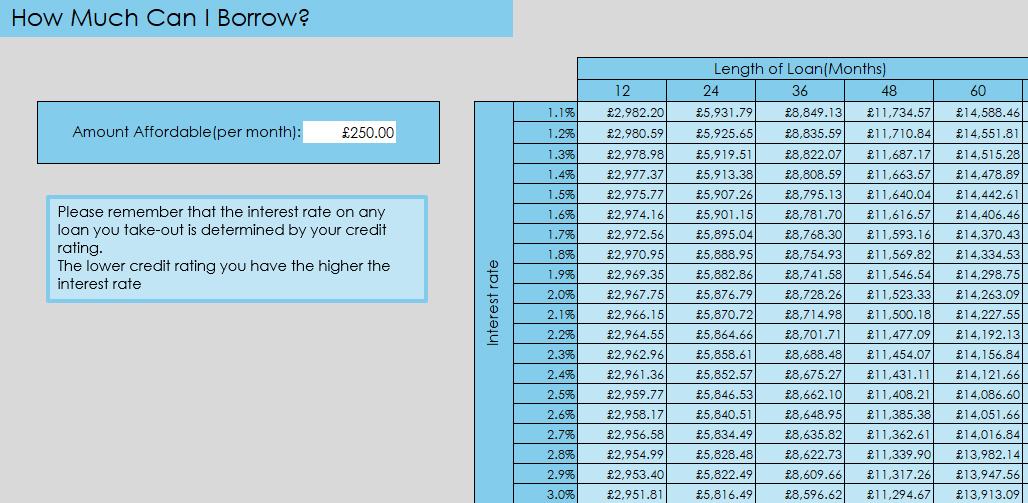

Managing personal loan payments can be challenging without a clear plan. However, understanding your repayment schedule, interest costs, and total loan expenses is essential for financial stability. That’s why our Personal Loan Calculator Excel template simplifies loan planning, making it easy to calculate payments, assess affordability, and track your progress. As a result, you can make better financial decisions with confidence.

User-Friendly and Efficient

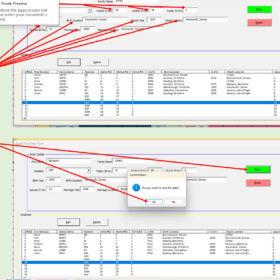

This Personal Loan Calculator template features a structured layout, allowing you to input loan details and instantly generate repayment information. Since all calculations are automated, you can quickly explore different scenarios by adjusting loan amounts, interest rates, and repayment periods. Consequently, you gain better control over your financial commitments. Furthermore, the intuitive design ensures that anyone can use it without prior financial expertise.

Key Features of the Personal Loan Calculator

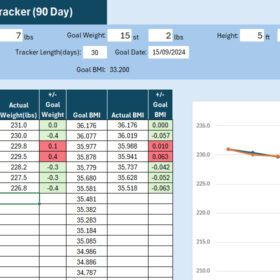

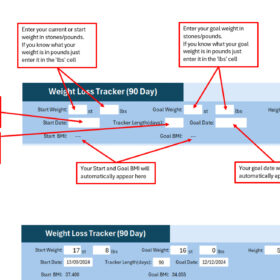

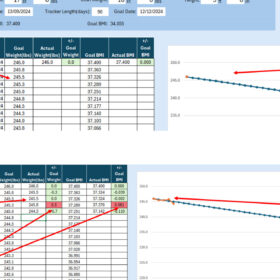

- Loan Breakdown: Enter loan amount, interest rate, and term to calculate monthly payments instantly.

- Amortisation Schedule: Track payment progress with a detailed breakdown of principal and interest. This helps you see how much you owe at any point.

- Extra Payment Options: See how additional payments can reduce loan duration and interest costs, ultimately saving you money in the long run.

- Visual Insights: Graphs and charts illustrate repayment trends over time, helping you better understand your financial situation.

- Customisable Fields: Adapt the template to suit various loan structures and terms, ensuring flexibility for different financial needs.

Ideal for Borrowers and Financial Planning

Whether you’re taking out a personal loan for a car, home improvement, or any other purpose, this Personal Loan Calculator provides clarity on your financial responsibilities. Moreover, by visualising your repayment schedule, you can plan effectively and avoid unexpected financial strain. Additionally, comparing different loan terms allows you to make smarter borrowing decisions, which can lead to significant savings.

Why Use This Personal Loan Calculator?

- Saves Time: Automates complex calculations for quick and accurate results. Thus, you don’t have to rely on manual computations.

- Improves Budgeting: Helps you understand the financial impact of a loan, allowing for better expense management.

- Reduces Uncertainty: Offers clear projections of payment schedules and interest costs, so you always know what to expect.

- Adaptable for Any Loan Type: Works for various personal loan structures and repayment plans, making it a versatile tool.

- Enhances Financial Control: Empowers you to make well-informed borrowing choices, giving you peace of mind when making loan commitments.

Take Control of Your Loan Repayments

Planning your loan repayments is crucial for financial stability. Therefore, with this Personal Loan Calculator, you can estimate your monthly payments, assess affordability, and explore different repayment options. Instead of relying on rough estimates, use a structured tool that provides accurate insights. As a result, you can make sound financial choices and avoid unnecessary debt stress. Download today and take charge of your financial future with confidence.

Reviews

There are no reviews yet.